A existing home loan customers b and balance transfer customers. Do I have to submit my original KYC. Axis bank home loan top up documents.

Axis Bank Home Loan Top Up Documents, Axis Bank Home Top-up Loan. I am working in a reputed company and holding a axis bank salary account noprotected. Bank statements and Salary slips certificate are generally needed by Axis Bank for income proof. Top-up loans can only be extended against complete residential property with no pending post disbursal documentation.

Check Home Loan Eligibility Criteria Documents Required Axis Bank From axisbank.com

Check Home Loan Eligibility Criteria Documents Required Axis Bank From axisbank.com

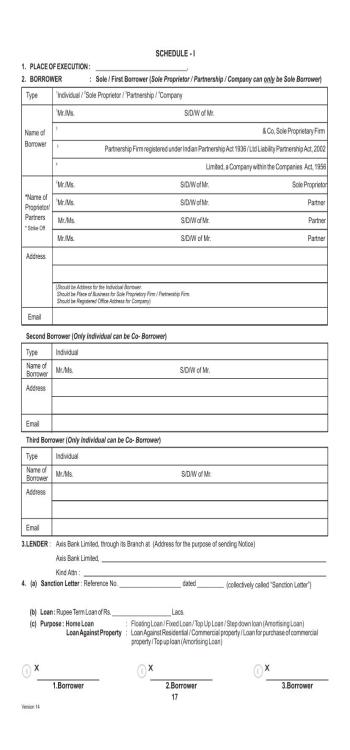

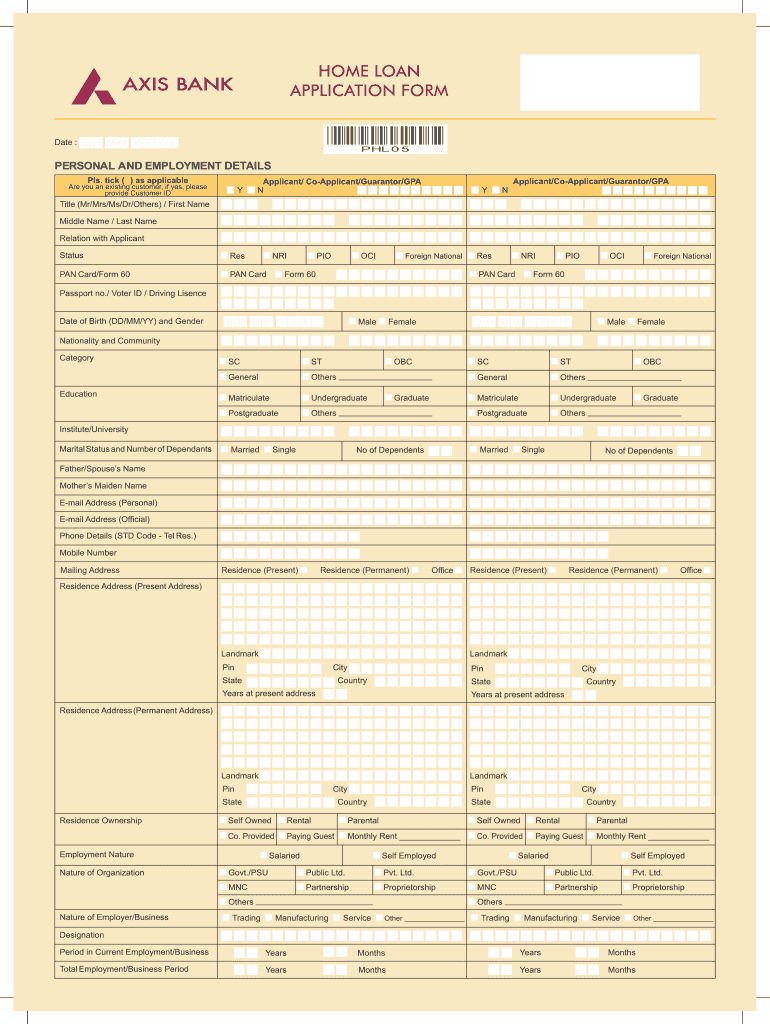

There should not be more than 1 EMI bounce in the last one year and the same should have been cleared before the next EMI date. Check Axis Bank Home Loan eligibility EMI calculator and documents required at Wishfin. Axis Bank offers home loans at attractive interest rates and flexible tenures. Fully filled and signed home loan application form.

A existing home loan customers b and balance transfer customers.

Read another article:

Top-up loans can be put to use only for property construction as it is available over. Calculate your home loan EMI. I was salaried earlier but now I am self-employed. Existing Home Loan customers are eligible for a. Axis Bank Home Loan.

Source: bankbazaar.com

Source: bankbazaar.com

Top-up up to Rs. This loan helps borrowers get access to funds for meeting their personal needs. What documents should I give in order to avail personal loan from Axis Bank. Axis Bank offers home loans at attractive interest rates and flexible tenures. Axis Bank Home Loan Status Steps To Check Application Status Online.

Source: nobroker.in

Source: nobroker.in

Axis Bank offers home loans at attractive interest rates and flexible tenures. I am working in a reputed company and holding a axis bank salary account noprotected. Axis Bank Home Loan. So for instance if your original home loan was worth Rs 1000000 and you have Rs 800000 outstanding you are eligible for a top up loan worth Rs 200000. Home Loan Sanction Letter Meaning Validity Format All You Must Know.

Source: truvisa.com

Source: truvisa.com

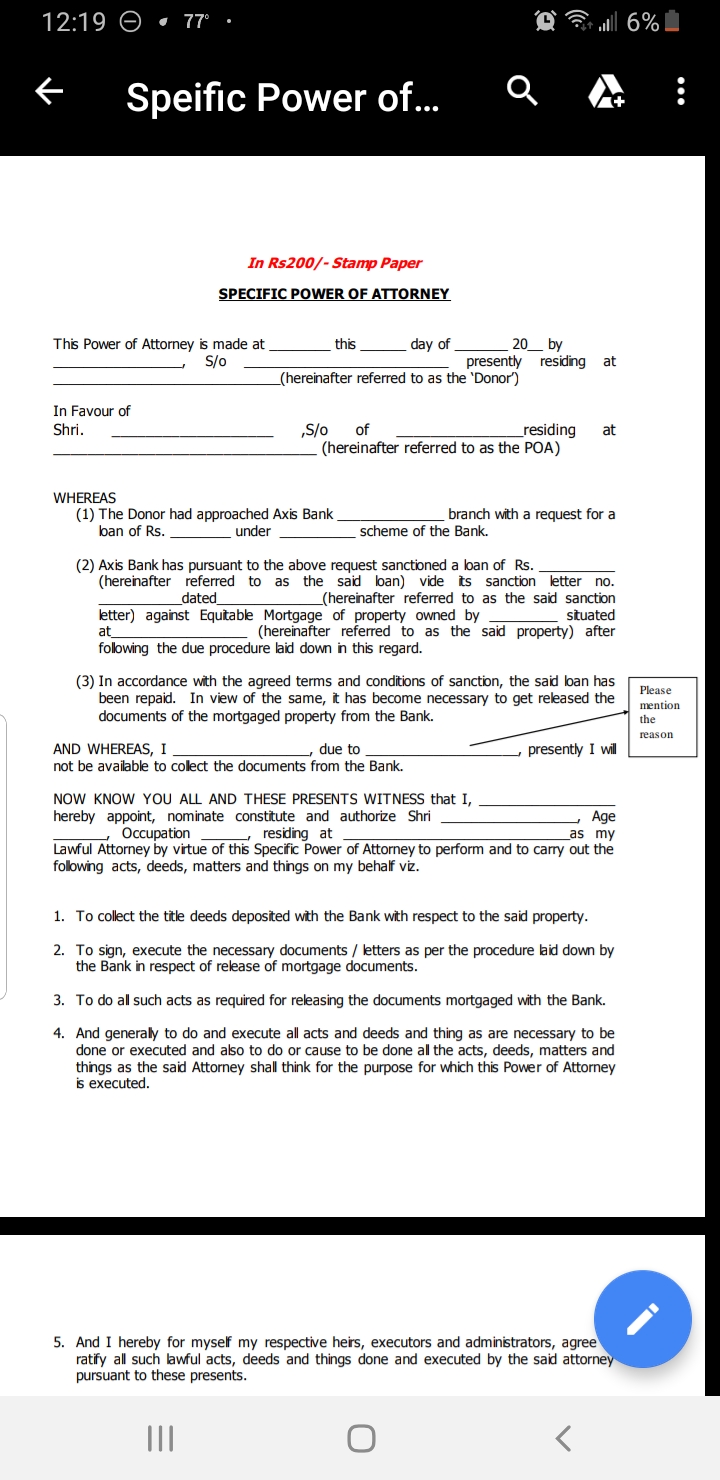

If you have an existing home loan from Axis Bank you can avail up to Rs50 lakh through the Axis Bank Top-Up Loan. This is a multi-purpose loan that can be used or personal or business reasons or even to construct a residential or commercial property. Duly filled and signed application form Passport size photographs Proof of Identity PAN Card AadhaarPassport Drivers License Voter ID Card Proof of Address A recent copy of Utility Bills Passport Driving License Aadhaar. Check Axis Bank Home Loan eligibility EMI calculator and documents required at Wishfin. How To Get Poa Just To Collect The Home Loan Document From Axis Bank Usa Truvisa Immigration Visa Questions Reliable Answers.

Source: axisbank.com

Source: axisbank.com

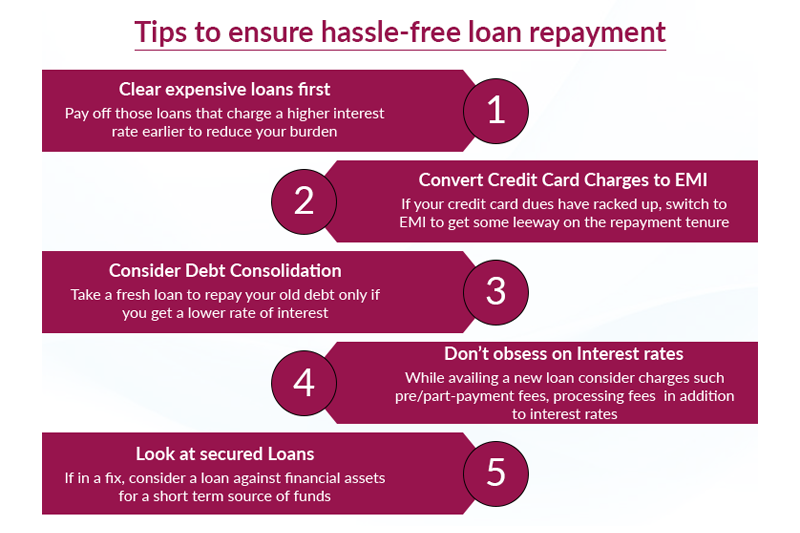

A top up loan from Axis Bank is based on the balance principal outstanding. I am siva raman from chennai. Axis Bank offers affordable flexible HousingHome Loans online which are available with Nil prepayment charges Low Interest rates Quick. Find eligibility and documents. Five Tips To Follow When Planning Loan Repayment.

Source: pdffiller.com

Source: pdffiller.com

So here are the list of documents which you need to submit to bank when you apply for an home loan in Axis Bank. Apply for Axis Bank Home Loan online at interest rates as low as 675. A existing home loan customers b and balance transfer customers. Top-up personal loan is an additional amount that you can borrow on an existing personal loan after you have completed a specified number of EMI payments. Axis Bank Home Loan Form Pdf Fill Online Printable Fillable Blank Pdffiller.

Source: bankbazaar.com

Source: bankbazaar.com

Similar to a personal loan a top-up personal loan also features flexible end-use for various personal purposes such as wedding expenses vacation expenses medical emergencies home renovation. Bank statements and Salary slips certificate are generally needed by Axis Bank for income proof. I was salaried earlier but now I am self-employed. The processing fee charged on top up loans is up to 25 percent. How To Get Axis Bank Personal Loan Account Statement.

Source: bankbazaar.com

Source: bankbazaar.com

What documents should I give in order to avail personal loan from Axis Bank. At present Axis Bank only offers personal loans to salaried individuals. A top up loan from Axis Bank is based on the balance principal outstanding. Axis Bank Home Loan. How To Get Axis Bank Personal Loan Account Statement.

Source: bankbazaar.com

Source: bankbazaar.com

A existing home loan customers b and balance transfer customers. Axis Bank Home Top-up Loan. Axis Bank home loan available at interest rates of 690. 50 Lakh basis eligibility. How To Get Axis Bank Personal Loan Account Statement.

Source: axisbank.com

Source: axisbank.com

Calculate your home loan EMI. The processing fee charged on top up loans is up to 25 percent. Similar to a personal loan a top-up personal loan also features flexible end-use for various personal purposes such as wedding expenses vacation expenses medical emergencies home renovation. At present Axis Bank only offers personal loans to salaried individuals. Step By Step Guide On The Home Loan Application Process Axis Bank.

Source: bankbazaar.com

Source: bankbazaar.com

I got a pre-approved loan in axis bank ac in the year 2014 for rs60000-. The bank charges a processing fee of 1 of the loan amount subject to a minimum of Rs10000 plus applicable taxes. At present Axis Bank only offers personal loans to salaried individuals. This loan helps borrowers get access to funds for meeting their personal needs. Axis Bank Home Loan Status Steps To Check Application Status Online.

Source: bankbazaar.com

Source: bankbazaar.com

This is a multi-purpose loan that can be used or personal or business reasons or even to construct a residential or commercial property. Do I have to submit my original KYC. Axis Bank Home Loan Top Up loan facility is available for. I was salaried earlier but now I am self-employed. Axis Bank Home Loan Status Steps To Check Application Status Online.

Source: axisbank.com

Source: axisbank.com

What documents should I give in order to avail personal loan from Axis Bank. There should not be more than 1 EMI bounce in the last one year and the same should have been cleared before the next EMI date. For an existing home loan borrower clear repayment history is important. The bank charges a processing fee up to 1 of the loan amount with interest rates from 895 pa. Check Home Loan Eligibility Criteria Documents Required Axis Bank.

Source: bankbazaar.com

Source: bankbazaar.com

Additional property loan for personal or business requirements. Can also be used as home construction or home improvement loans. So for instance if your original home loan was worth Rs 1000000 and you have Rs 800000 outstanding you are eligible for a top up loan worth Rs 200000. The documents required to apply for Axis Bank Top Up Home Loan are. Axis Bank Home Loan Status Steps To Check Application Status Online.

Source: topsharebrokers.com

Source: topsharebrokers.com

A Top Up Loan is an additional loan provided by a housing finance company on an existing home loan with minimal new documentation. I regularly pay the emi. The bank charges a processing fee of 1 of the loan amount subject to a minimum of Rs10000 plus applicable taxes. Check Axis Bank Home Loan eligibility EMI calculator and documents required at Wishfin. Axis Bank Personal Loan Interest Rates Fees And Charges.

Source: consumercomplaints.in

Source: consumercomplaints.in

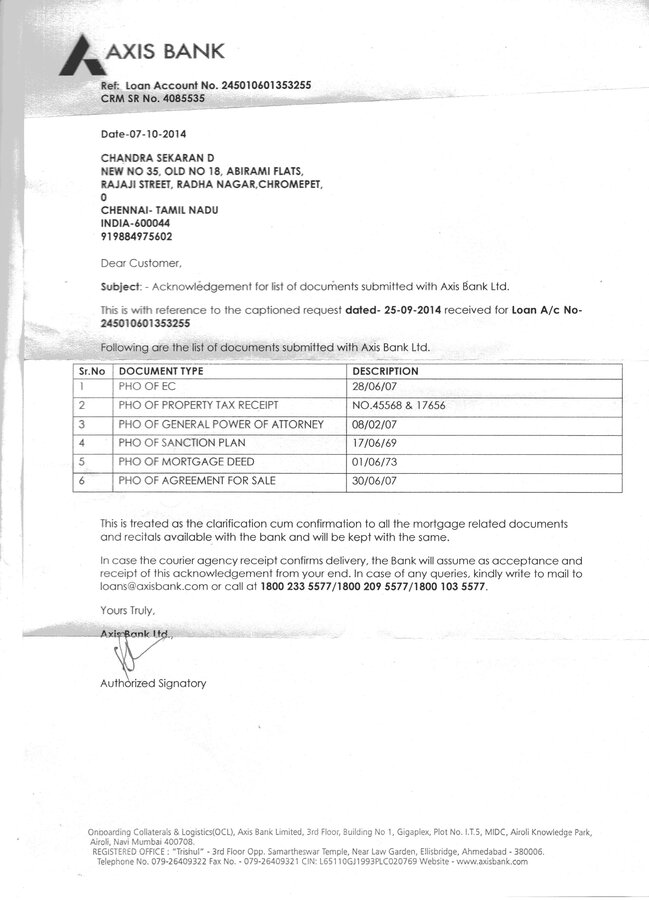

Bank statements and Salary slips certificate are generally needed by Axis Bank for income proof. I regularly pay the emi. The bank charges a processing fee of 1 of the loan amount subject to a minimum of Rs10000 plus applicable taxes. Click here to know more about its interest rates. Resolved Axis Bank My Original Sale Deed Is Missing From Axis Bank Loan Center.