Under this scheme you can avail a Home Loan for purchasing an under construction ready builder property resale house self-construction plot plus construction home extension improvement loans. 3 Lakhs No PrePayment Charges. Axis bank home loan scheme.

Axis Bank Home Loan Scheme, Maximum of 30 years. Who does not want a few of their home loan EMIs to be waived off. The home loans from Axis Bank start at Rs300000. Minimum of Rs3 lakh.

The home loan schemes offer many benefits and the EMI is also small and flexible which the borrower can get customized based on his paying capability. Home Loan Balance Transfer is a facility offered by Axis Bank for moving your outstanding home loan easily at a lower interest rate. Our Home Loan affordability calculator is based on your requirements such as tenure loan amount and interest rates to give you an estimate of your EMI. Find out more about the Axis Bank Home Loan below.

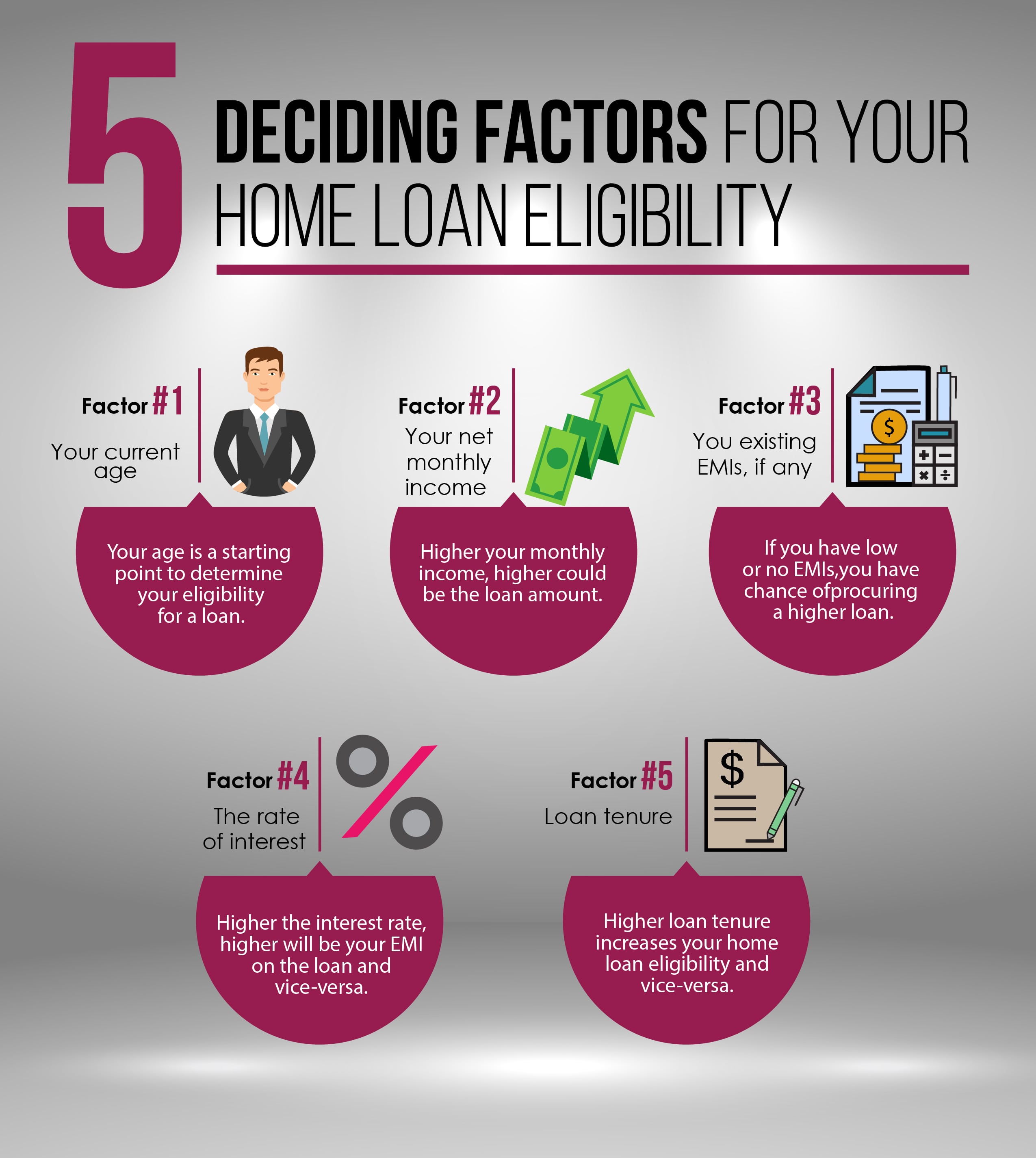

Who is eligible and what is the rate of interest.

Read another article:

The name of the scheme is Shubh Aarambh Home Loan at the interest rate similar to the regular home loan. With a range of Axis Bank Home Loans buy your dream home with tax-saving and low-interest rates benefits unlike the other loans. Processing fees is 1 of the loan amount minimum of Rs10000. Axis Bank already offers affordable housing scheme called Asha home loan which is for the lower income group applicants of loans up to 25 lakhs. The axis bank home loan rates are flexible as well as fixed that can help you to grow your fund for your dream home.

Source: youtube.com

Source: youtube.com

The name of the scheme is Shubh Aarambh Home Loan at the interest rate similar to the regular home loan. 3 Lakhs No PrePayment Charges. Find out more about the Axis Bank Home Loan below. I am not speaking about the EMI moratorium scheme introduced due to Covid crisis in 2020. Axis Bank Home Loans With 12 Emis Off Youtube.

Source: axisbank.com

Source: axisbank.com

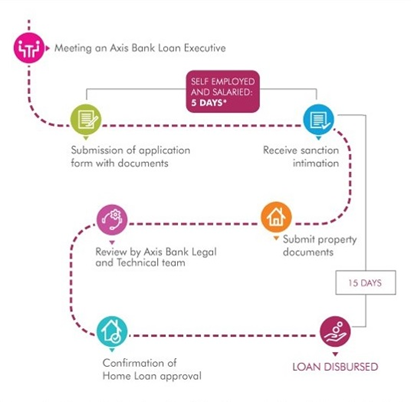

The Axis Bank Home Loan comes with a host of benefits such as smaller EMIs where you can space out your payment over a longer tenure attractive interest rates an easy application process doorstep service etc. Find out more about the Axis Bank Home Loan below. Axis Bank has recently introduced its new home loan product under which the borrower gets the chance to pay 12 EMIs less on a home loan for a tenure of 20 years. Minimum of Rs3 lakh. Home Loan Apply Housing Loan Online 6 75 Interest Rate At Axis Bank.

Source: m.economictimes.com

Source: m.economictimes.com

Axis Bank Home Extension Loans For Adding Space in Your Home. With the Shubh Aarambh Home Loan you can take advantage of interest subsidy on qualifying under Pradhan Mantri Awas Yojana Scheme. Read the features here. You can space out the tenure of loan repayment with the Axis Bank home loans. Axis Bank S New Home Loan Offering Can Help Bring Down Interest Cost Here S How The Economic Times.

Source: bankbazaar.com

Source: bankbazaar.com

What is the maximum loan amount that can be availed under this scheme. When and how are the EMIs waived. Can I avail of this scheme under a fixed rate option. Axis Bank has recently introduced a home loan scheme called Shubh Aarambh Home Loans which offers waiver of 12 EMIs. Axis Bank Home Loan Status Steps To Check Application Status Online.

Source: apnaplan.com

Source: apnaplan.com

Home Loan Balance Transfer is a facility offered by Axis Bank for moving your outstanding home loan easily at a lower interest rate. With the Shubh Aarambh Home Loan you can take advantage of interest subsidy on qualifying under Pradhan Mantri Awas Yojana Scheme. Can I avail of this scheme under a fixed rate option. The home loan schemes offer many benefits and the EMI is also small and flexible which the borrower can get customized based on his paying capability. Axis Bank Happy Ending Home Loan Review.

Source: axisbank.com

Source: axisbank.com

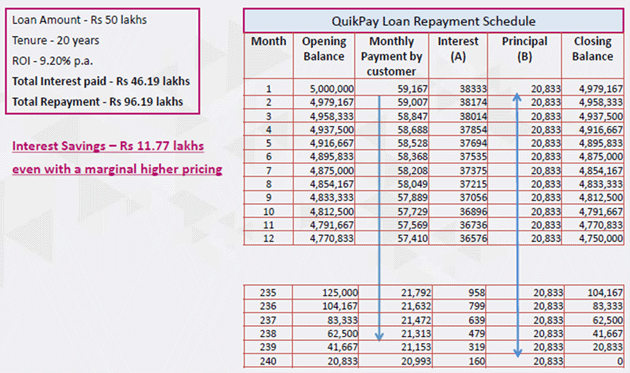

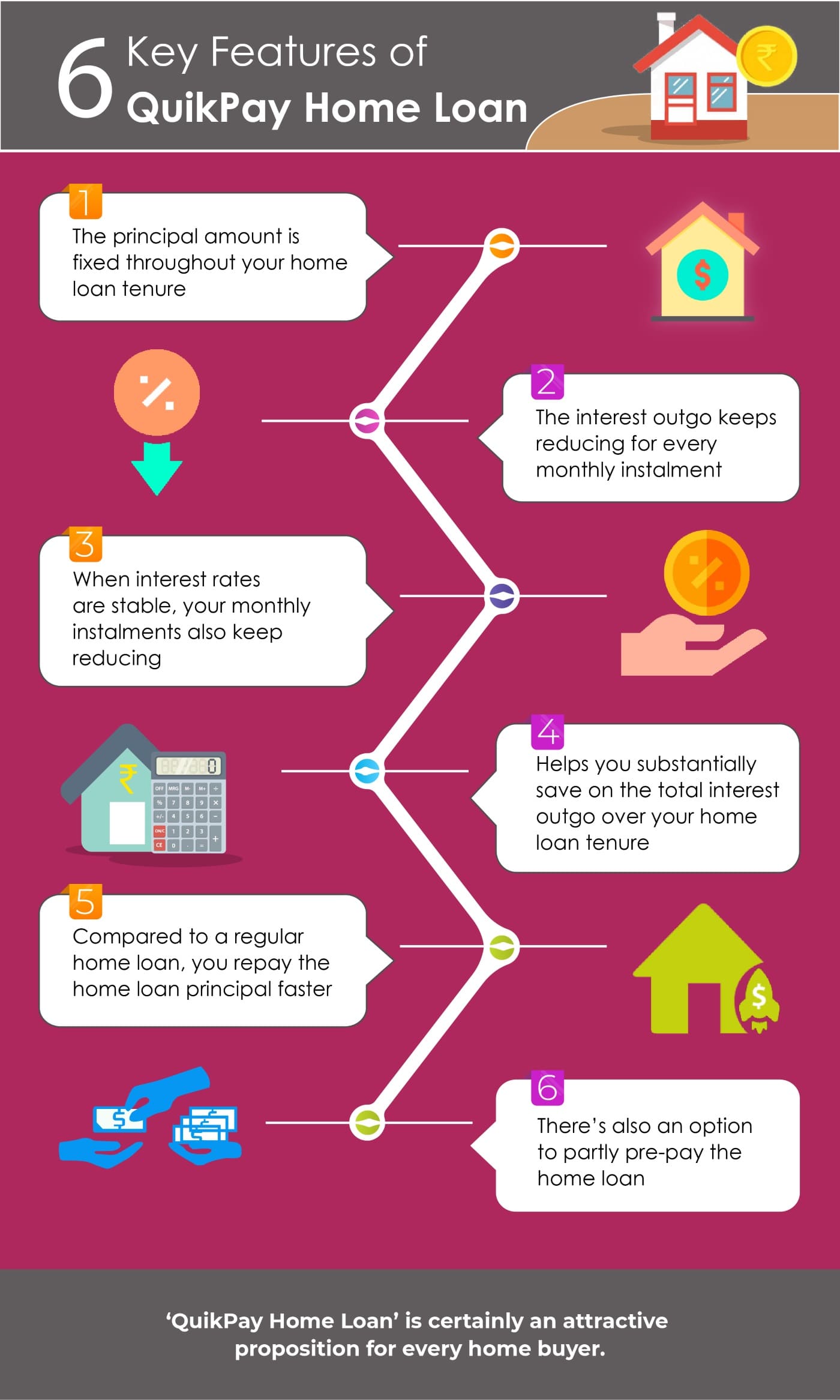

The Axis Bank QuikPay Home Loan has been specially designed to help you repay a larger portion of your principal loan amount in the earlier part of your loan tenure. Under the moratorium scheme EMIs were just postponed and not waived. Axis Bank Home Loans Our affordable and flexible home loans are designed to take you closer to your dream home. What is the maximum loan as a percentage to the property value permissible under this scheme. 5 Deciding Factors Axis Bank.

Source: axisbank.com

Source: axisbank.com

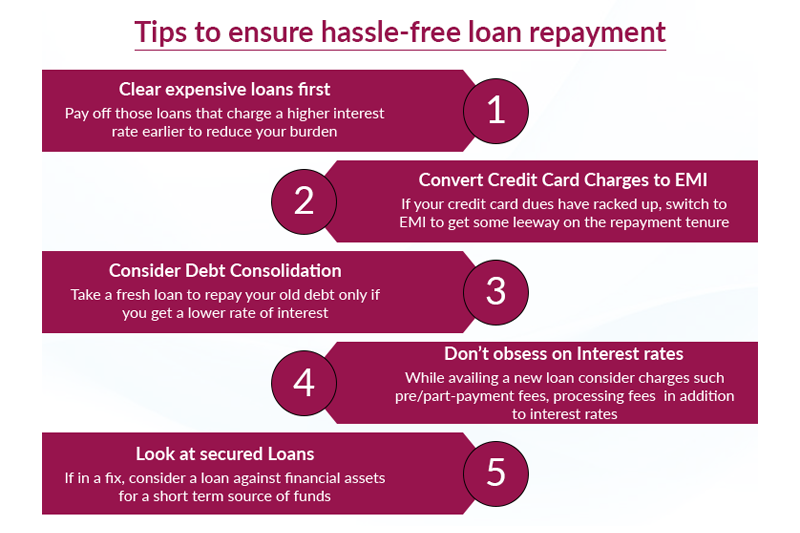

Under the moratorium scheme EMIs were just postponed and not waived. You can space out the tenure of loan repayment with the Axis Bank home loans. 3 Lakhs No PrePayment Charges. The home loans from Axis Bank start at Rs300000. Five Tips To Follow When Planning Loan Repayment.

Source: ekikrat.in

Source: ekikrat.in

Axis Bank Home Extension Loans For Adding Space in Your Home. Our Home Loan affordability calculator is based on your requirements such as tenure loan amount and interest rates to give you an estimate of your EMI. Pradhan Mantri Awas Yojna The Pradhan Mantri Awas Yojana PMAY Credit Linked Subsidy Scheme CLSS - Housing for all is a home loan scheme launched in the year 2015. I am not speaking about the EMI moratorium scheme introduced due to Covid crisis in 2020. Axis Bank Home Loan Ekikrat In.

Source: bankbazaar.com

Source: bankbazaar.com

Axis Bank home loan available at interest rates of 690. Can I avail of this scheme under a fixed rate option. With a range of Axis Bank Home Loans buy your dream home with tax-saving and low-interest rates benefits unlike the other loans. The axis bank home loan rates are flexible as well as fixed that can help you to grow your fund for your dream home. Axis Bank Home Loan Status Steps To Check Application Status Online.

Source: axisbank.com

Source: axisbank.com

This will reduce your monthly instalment payments and allow you to maximise savings on interest payments. When and how are the EMIs waived. Under this scheme you can avail a Home Loan for purchasing an under construction ready builder property resale house self-construction plot plus construction home extension improvement loans. Home Loan Balance Transfer is a facility offered by Axis Bank for moving your outstanding home loan easily at a lower interest rate. Quikpay Home Loan Reduce The Interest Outgo Of Your Home Loan.

Source: axisbank.com

Source: axisbank.com

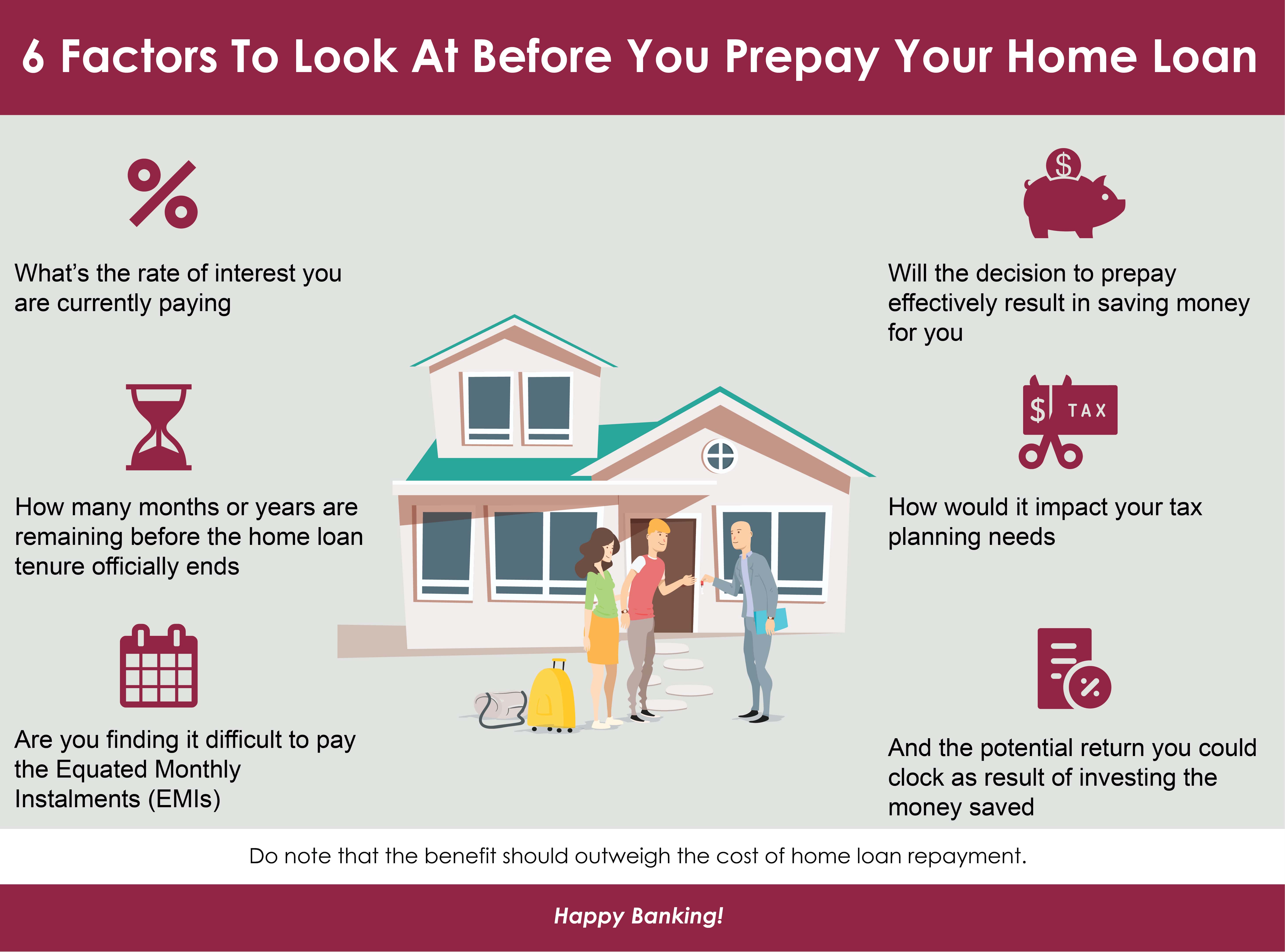

The Axis Bank Home Loan comes with a host of benefits such as smaller EMIs where you can space out your payment over a longer tenure attractive interest rates an easy application process doorstep service etc. I am not speaking about the EMI moratorium scheme introduced due to Covid crisis in 2020. Axis Bank has recently introduced its new home loan product under which the borrower gets the chance to pay 12 EMIs less on a home loan for a tenure of 20 years. With the Axis Bank Loan Restructuring Scheme borrowers can extend their overall tenure by a maximum of 24 months. Home Loan Prepayment 6 Factors To Look At Before You Prepay Your Home Loan.

Source: bankbazaar.com

Source: bankbazaar.com

Our Home Loan affordability calculator is based on your requirements such as tenure loan amount and interest rates to give you an estimate of your EMI. Smaller EMIs Minimum Loan Amount Rs. Axis Bank home loan available at interest rates of 690. The axis bank home loan rates are flexible as well as fixed that can help you to grow your fund for your dream home. Axis Bank Home Loan Status Steps To Check Application Status Online.

Source: iservefinancial.com

Source: iservefinancial.com

This will reduce your monthly instalment payments and allow you to maximise savings on interest payments. Axis Bank has recently introduced a home loan scheme called Shubh Aarambh Home Loans which offers waiver of 12 EMIs. 3 Lakhs No PrePayment Charges. What is the maximum loan as a percentage to the property value permissible under this scheme. Axis Bank Loan Against Property.

Source: loanfestival.in

Source: loanfestival.in

Axis Bank home loan available at interest rates of 690. Home Loan Balance Transfer is a facility offered by Axis Bank for moving your outstanding home loan easily at a lower interest rate. Minimum of Rs3 lakh. The home loan schemes offer many benefits and the EMI is also small and flexible which the borrower can get customized based on his paying capability. Axis Bank Home Loan How To Apply For Axis Bank Home Loan Interest.

Source: creditmantri.com

Source: creditmantri.com

Under the moratorium scheme EMIs were just postponed and not waived. Asha home loan accounts for around 5 per cent of its mortgage book and as of June the home loans constituted a whopping 44 per cent of the 168 trillion retail portfolios of the bank. Maximum of 30 years. The home loan schemes offer many benefits and the EMI is also small and flexible which the borrower can get customized based on his paying capability. Axis Bank Home Loan At Lowest Interest Rates 8 65 Apply Online Now.