NO prepayment charges on home loans linked to floating rate of interest. Banks and other lending companies offer loans of up to a whopping 90 of the total value of the house property. 90 percent home loan india.

90 Percent Home Loan India, 30 lakh and up to Rs. 75 to 90 of the property cost is what can be availed as a home loan. NO prepayment charges on home loans linked to floating rate of interest. In case of construction home improvement and home extension loans 75 to 90 of the constructionimprovementextension estimate can be funded.

Sbi Home Loans From homeloans.sbi

Sbi Home Loans From homeloans.sbi

In case of construction home improvement and home extension loans 75 to 90 of the constructionimprovementextension estimate can be funded. And for properties above Rs 75 Lacs 75 of property value can be disbursed as home loan. According to the guidelines issued by the Reserve Bank of India RBI the LTV ratio for home loans can go up to 90 of the property value for loan amounts of Rs. In a significant relaxation for the housing finance segment the Reserve Bank of India RBI on Thursday increased the amount of loan banks can give against a property purchase loan-to-value LTV and also reduced the risk weights for home loans.

The contributory employees of the provident fund PF scheme to use 90 percent of EPF.

Read another article:

A borrower can avail up to Rs35 crore as a mortgage loan with the. LTV ratio at 90 means a home loan borrower can avail a loan of Rs 90 lakh against a property value of Rs 1 crore. Earlier 90 LTV was allowed only for loans up to 20 lakh. Therefore in the first month 10 rate is charged on full Rs. People with knowledge of the matter said NHBs efforts are aimed at increasing the LTV ratio for loans above Rs 20 lakh to 90 from 80 now.

Source: financialexpress.com

Source: financialexpress.com

NO prepayment charges on home loans linked to floating rate of interest. Earlier 90 LTV was allowed only for loans up to 20 lakh. As per the Reserve Bank of India provision the maximum amount of loan that can be availed by a borrower stands at 80. 30 lakh and up to Rs. 5 Things To Know Before Going To A Lender For A Home Loan The Financial Express.

Source: housing.com

Source: housing.com

50 lakhs the maximum amount you can get is 85 of that ie 4250 lakhs. Bank of Baroda is offering a good deal to customers who are transferring their home loan account to the bank. 75 lakh the LTV ratio limit has been set to up to 80 while for loan amounts above Rs. In case of construction home improvement and home extension loans 75 to 90 of the constructionimprovementextension estimate can be funded. Home Loan For Resale Flats Eligibility Documents Tax Benefits.

Source: businesstoday.in

Source: businesstoday.in

State Bank of India is offering attractive interest rates starting at 690 pa. Which Banks Provide 90 Home Loans In India. Therefore if you want a home loan for buying a property of Rs. State Bank of India is offering attractive interest rates starting at 690 pa. Looking For Best Deals On Home Loan Check Out Cheapest Rates Festive Offers Businesstoday.

Source: pinterest.com

Source: pinterest.com

However if the property that you wish to purchase is below Rs35 lakh you can avail up to 90 housing finance with the home loan. Click the banks website for more details. The contributory employees of the provident fund PF scheme to use 90 percent of EPF. 010 of 1000000- is 1000- per month till the tenure of your home loan. Best Ways To Increase Your Home Loan Eligibility Home Loans Good Credit Savings And Investment.

Source: pinterest.com

Source: pinterest.com

75 lakh the LTV ratio can go up to 75. You are required to pay 10-25 of the total property cost as own contribution depending upon the loan amount. 75 lakh the LTV ratio limit has been set to up to 80 while for loan amounts above Rs. This can also prove financially viable when they securitise home loan portfolios. How To Get A Loan Against Property Easily Get A Loan Mortgage Loans Loan.

Source: businesstoday.in

Source: businesstoday.in

EPFO has allowed members ie. Looking for the best home loan product to fund the purchase of your dream home. 75 to 90 of the property cost is what can be availed as a home loan. However if the property that you wish to purchase is below Rs35 lakh you can avail up to 90 housing finance with the home loan. Save Lakhs On Home Loan Here S What You Need To Do Businesstoday.

Source: etmoney.com

Source: etmoney.com

As per the RBIs direction all banks are instructed to provide home loans at the 90 value of the property for loans up to INR 30 Lakhs. Trick to get your Home Loan Interest Back. Banks and other lending companies offer loans of up to a whopping 90 of the total value of the house property. Home loan interest rates and EMI in top 15 banks in September 2021. Buying A Home Should You Use All Your Savings Or Take A Bigger Loan.

Source: zeebiz.com

Source: zeebiz.com

However if the property that you wish to purchase is below Rs35 lakh you can avail up to 90 housing finance with the home loan. Bank of Baroda is offering a good deal to customers who are transferring their home loan account to the bank. Looking for the best home loan product to fund the purchase of your dream home. 30 lakh and up to Rs. Explained How Personal Loan Can Help You Repay Home Loan Here Is Easy Guide Zee Business.

Source: idfcfirstbank.com

Source: idfcfirstbank.com

Banks and other lending companies offer loans of up to a whopping 90 of the total value of the house property. Bank of Baroda is offering a good deal to customers who are transferring their home loan account to the bank. You are required to pay 10-25 of the total property cost as own contribution depending upon the loan amount. Banks also consider other specific criteria before accepting the property for granting a. How Home Loan Eligibility Is Calculated On Your Salary Idfc First Bank.

Source: businesstoday.in

Source: businesstoday.in

Generally the banks provide maximum upto 85 of loan against the value of property. Keep aside 010 of your home loan amount. As per the RBIs direction all banks are instructed to provide home loans at the 90 value of the property for loans up to INR 30 Lakhs. And for properties above Rs 75 Lacs 75 of property value can be disbursed as home loan. Save Lakhs On Home Loan Here S What You Need To Do Businesstoday.

Source: indiatvnews.com

Source: indiatvnews.com

As per the RBI guidelines all banks and housing finance companies can approve 90 of property value as home loan if the property is up to Rs 30 Lacs. For more than that limit the banks may demand 20 of the margin. 75 lakh the LTV ratio can go up to 75. 010 of 1000000- is 1000- per month till the tenure of your home loan. Sbi Home Loan State Bank Of India Home Loan Gets Cheaper Sbi Cuts Mclr Rllr Base Rate Rbi Monetary Policy Business News India Tv.

Source: moneyview.in

Source: moneyview.in

Therefore in the first month 10 rate is charged on full Rs. The Loan-to-Value ratio is guided by RBI regulations which state that individual housing loans can be funded up to 90 of the value if the total loan is up to Rs. Therefore if you want a home loan for buying a property of Rs. Earlier 90 LTV was allowed only for loans up to 20 lakh. 100 Percent Home Loan Can We Get 100 Financed Home Loans.

Source: newindianexpress.com

Source: newindianexpress.com

The government it seems is pulling out all the stops in making Housing for All by 2022 a success. According to the guidelines issued by the Reserve Bank of India RBI the LTV ratio for home loans can go up to 90 of the property value for loan amounts of Rs30 lakh and below. 75 lakh the LTV ratio limit has been set to up to 80 while for loan amounts above Rs. Looking for the best home loan product to fund the purchase of your dream home. How To Take Advantage Of Record Low Home Loan Rates The New Indian Express.

Source: homeloans.sbi

Source: homeloans.sbi

In a notification RBI allowed a loan-to-value ratio LTV of up to 90 for home loans of 30 lakh or less. The contributory employees to dip into their retirement savings to own a home of their own. Which Banks Provide 90 Home Loans In India. This can also prove financially viable when they securitise home loan portfolios. Sbi Home Loans.

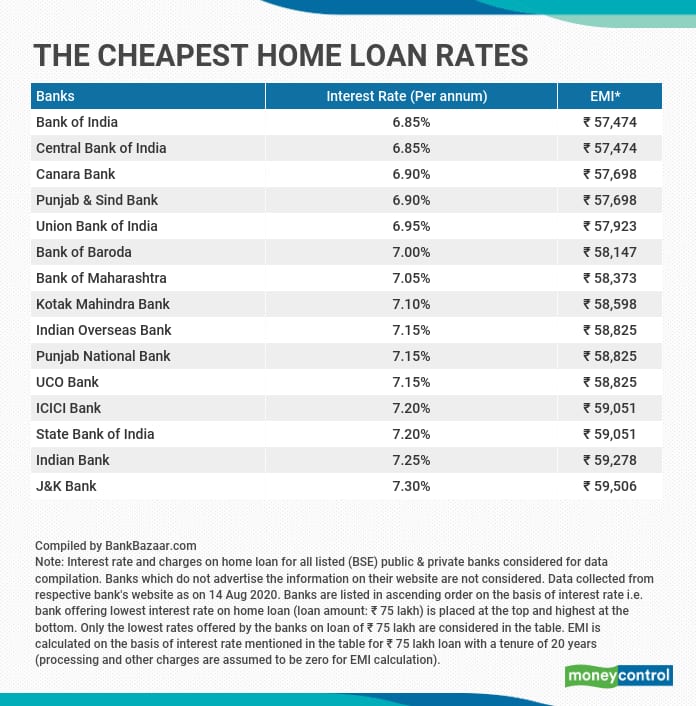

Source: moneycontrol.com

Source: moneycontrol.com

The Loan-to-Value ratio is guided by RBI regulations which state that individual housing loans can be funded up to 90 of the value if the total loan is up to Rs. According to the guidelines issued by the Reserve Bank of India RBI the LTV ratio for home loans can go up to 90 of the property value for loan amounts of Rs. Which Banks Provide 90 Home Loans In India. It is offering a discount of 025 percent on its current home loan interest. Home Loans That Come With The Lowest Interest Rate.